The Offshore Technology Conference (OTC) in Houston, Texas celebrates its 50th birthday this week, begging the question – what will the next 50 years hold for the offshore market?

Luckily, the data can provide some clues. Rystad Energy has analyzed the historic investments and oilfield service purchases of the world’s 50,000 oil and gas fields (1). While the forecast is uncertain, our analysis paints a fascinating picture of how offshore could contribute to the future of the service industry.

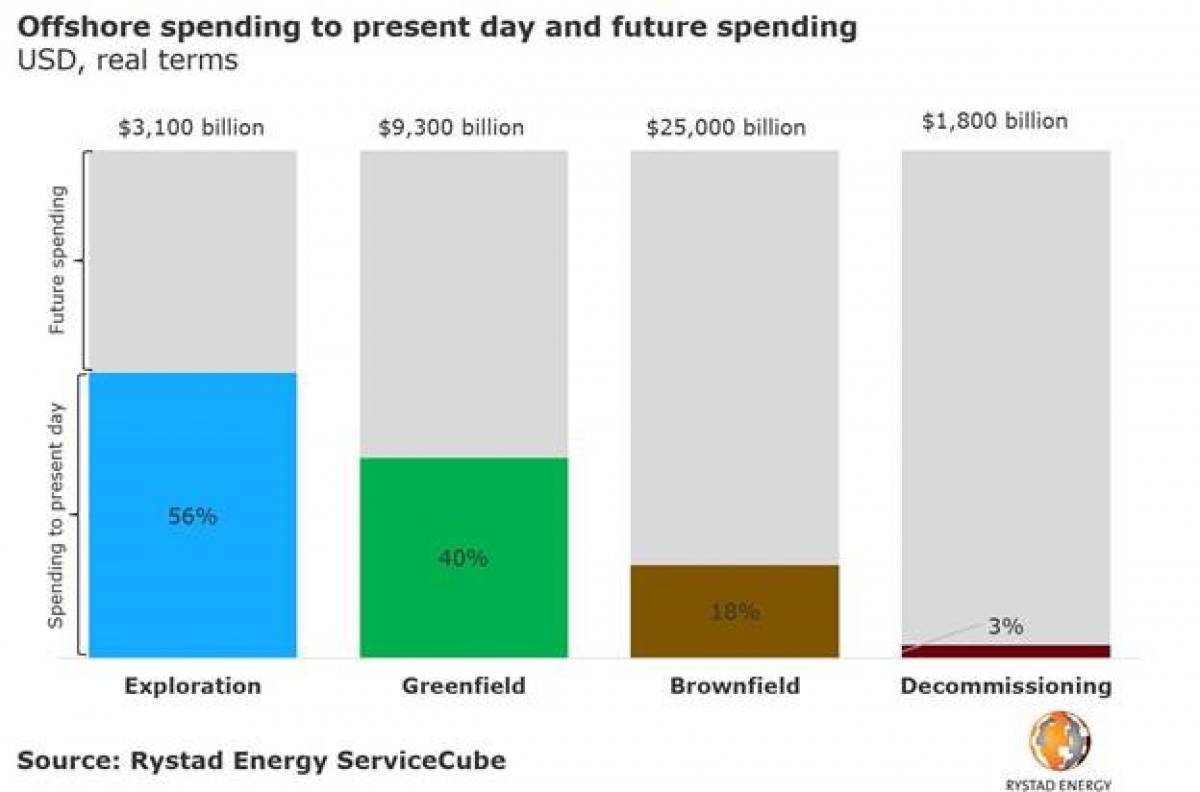

“Total greenfield project sanctioning, summed up to the present day, only accounts for 40% of estimated volumes of offshore projects ever being sanctioned. Likewise, the brownfield market has only begun, with total historical expenditures accounting for only about 20% of estimated brownfield spend over the projects lifetime, leaving 80% of brownfield spending to the future. And the decommissioning market is still in its nascent form,” says Audun Martinsen, head of oilfield services research at Rystad Energy.

Let’s drill down through the data.

Exploration

We estimate that around 800 billion undiscovered barrels of oil and gas equivalents exist globally, hinting that exploration will still be in business in the next 50 years.

“However, we expect offshore’s appetite for exploration to continue to weaken long term as more potential resources are discovered. Exploration will likely be forced into deeper and more remote waters, which could be too expensive to develop given the availability of other competitive sources of supply,” Martinsen said.

“However, we expect offshore’s appetite for exploration to continue to weaken long term as more potential resources are discovered. Exploration will likely be forced into deeper and more remote waters, which could be too expensive to develop given the availability of other competitive sources of supply,” Martinsen said.

Greenfield

Greenfield projects are new developments of new oil and gas fields. Historically, sanctioned greenfield projects have racked up total investments of about $3700 billion in real dollars worldwide. In total, greenfield sanctioning has likely only achieved 40% of its potential with reference to total global reserves.

“This means that there is tremendous room for growth,” Martinsen added.

Brownfield

Brownfield projects are expansions or upgrades of existing oil and gas fields. Of the 3,000 oil and gas fields producing today, 50% could still be producing in 2030 due to improved depletion rates through the use of advanced technology. In addition, upcoming projects already under development or expected to be sanctioned represent an additional 2500 oil and gas fields.

“Assuming that oil and gas will still be consumed for petrochemical use and power production through 2100, we expect to spend five to six times as much on brownfield services as what has been spent as of today,” Martinsen remarked.

Decommissioning

The most immature market in the upstream oil and gas market is decommissioning. We estimate that only 3% of necessary decommissioning expenditures has already been spent, which entails the cost of removing, plugging and abandoning existing and to-be developed oil fields.

“Decommissioning represents a very interesting market for service companies, but in terms of size it is a relatively small $1800 billion market,” Martinsen said.

Maintenance and operations

The maintenance and operations service segment is naturally the market with the most volume of work ahead, with 58% of the market to be spent in the future representing $20,500 billion in expenditures.

“Well Services and Commodities, Drilling Contractors, EPCI, and Subsea are equally large markets which we expect will make significant contributions to the service sector in the next 50 years,” Martinsen commented.

Commenting on the overall findings, Martinsen says:

“Despite oil price downturns, the shale revolution and OPEC market share wars, offshore continues to thrive and has much to offer the future.”

Notes: (1) This calculation includes the licenses which have been spent, and an expectation of what is likely to be spent. Situated within our assumption of a global oil demand peak in early 2030s, and the likely cost and estimated ultimate recoveries of resources, our future spending expectations are based on yet-to-find potential, unsanctioned discoveries, the expected life time of existing fields, and decommissioning obligations.